Understanding Risk Management in Binary Options Trading

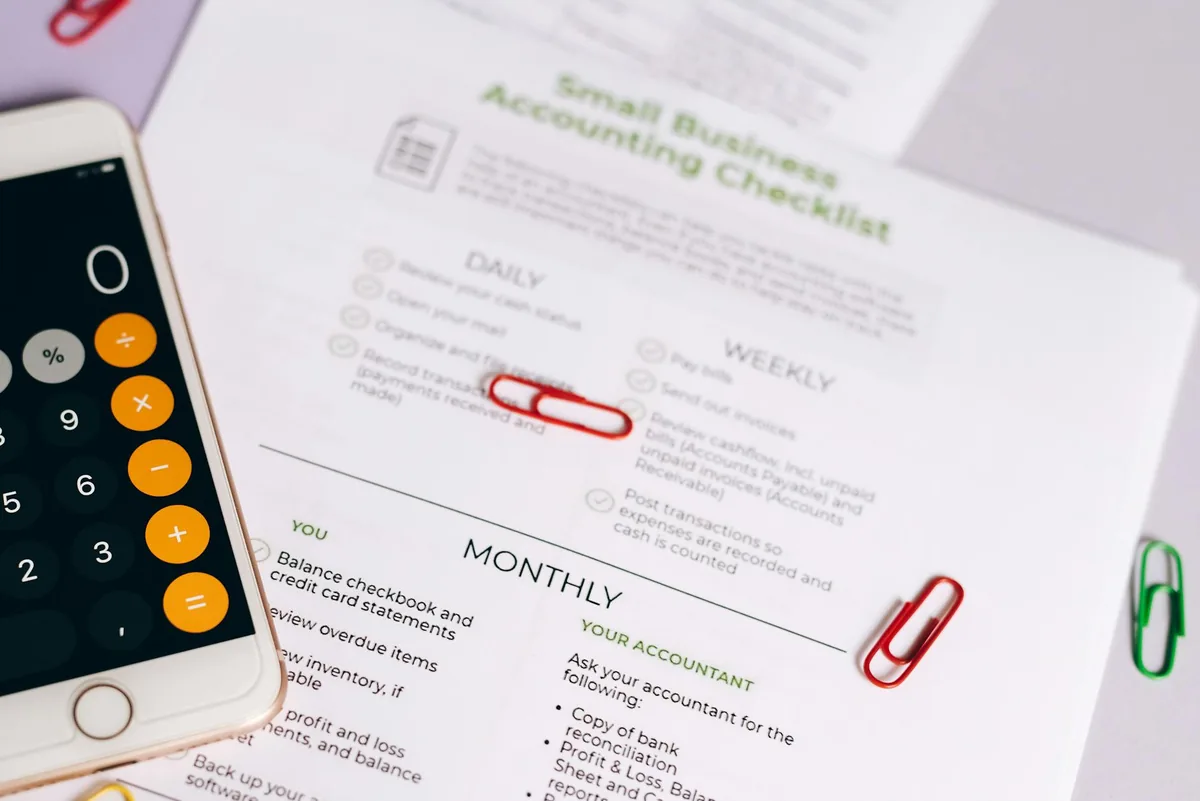

Risk Management Checklist is one of the most practical approaches for traders on Binomo.  Learn more on Binomo.

Learn more on Binomo.

Risk Management Checklist: Why It Is Crucial for Traders

The Risk Management Checklist is a fundamental tool every binary options trader must utilize to safeguard their trading capital effectively. Understanding risk management means recognizing potential pitfalls and preparing strategies to mitigate them while trading high-risk assets on platforms like Binomo.

Common Risks in Binary Options Trading with Risk Management Checklist

Common risks include market volatility, unexpected news events, platform execution delays, and psychological biases. Binary options trading exposes traders to fast-paced changes that, if unmanaged, can erode their investment rapidly.

The Impact of Poor Risk Management on Capital

Poor risk management often results in overexposure, emotional trading, and substantial capital loss. Without limits and predefined rules, traders may take unsustainable positions, leading to irreversible damage to their trading accounts.

Key Components of an Effective Risk Management Checklist

Setting Realistic Trading Goals with Risk Management Checklist

Establish clear, achievable objectives aligned with your trading style and capital size. Unrealistic goals often push traders to take excessive risks, which the Risk Management Checklist helps to avoid.

Determining Your Risk Tolerance

Assess how much capital you can afford to lose per trade without affecting your financial stability. This personal risk tolerance should be the cornerstone of your checklist and trading plan.

Establishing Maximum Loss Limits

Set daily, weekly, and monthly loss limits to protect your account from catastrophic drawdowns. Once these limits are reached, stop trading to reassess your strategy.

Practical Risk Management Techniques for Binary Options

Position Sizing and Capital Allocation in Your Risk Management Checklist

Allocate only a small percentage of your capital to each trade, typically 1-5%. This conservative approach limits losses and preserves capital for future opportunities.

Using Stop-Loss and Take-Profit Orders

Although traditional stop-loss orders are not always available in binary options, using time-based expiries and consistent profit targets serves a similar purpose to control risk.

Diversifying Your Trades to Minimize Risk with Risk Management Checklist

Spread your trades across different assets and expiry times to reduce exposure to any single market event. This diversity is a key element of the Risk Management Checklist.

Psychological Discipline and Risk Control

Avoiding Emotional Trading Decisions with Risk Management Checklist

Adhering strictly to your Risk Management Checklist helps prevent impulsive trades driven by fear or greed, which are common causes of losses.

Maintaining Consistency in Your Strategy

Consistent execution of your trading plan and checklist builds long-term success, avoiding the pitfalls of erratic behavior.

Recognizing and Managing Trading Stress

Be aware of stress signals that may impair judgment. Taking breaks and reviewing your checklist can help maintain a calm and controlled trading environment.

How to trade this on Binomo trading platform

Step-by-Step Setup of Risk Parameters on Binomo

On the Binomo trading platform, start by setting your maximum investment per trade in the interface. Use the demo account feature to practice your Risk Management Checklist without risking real money — Binomo Demo Trading Without Deposit: Quick Start Guide.

Implementing the Checklist During Live Trades

Apply your predetermined trade size, expiry times, and asset choices as per your checklist. Monitor each trade carefully and avoid increasing stakes impulsively.

Risk Notes: Managing High-Risk Binary Options

High-risk trades require stricter adherence to your checklist. Limit exposure and always be prepared to exit quickly if the market moves against you.

🚀 Ready to test this strategy? Sign up for a free Demo Account on Binomo today.

Monitoring and Reviewing Your Risk Management Plan

Tracking Your Trading Performance with Risk Management Checklist

Maintain a detailed log of trades, including wins, losses, and adherence to your checklist. This record is essential for evaluating your risk management effectiveness.

Adjusting Your Checklist Based on Results

Use your performance data to refine your checklist, adapting risk limits and strategies as your experience grows.

Learning from Losses and Wins

Analyze both successful and unsuccessful trades to understand risk factors better and improve your future decisions.

Advanced Tools and Indicators to Enhance Risk Management

Using Technical Indicators for Better Entry and Exit

Incorporate indicators like Moving Averages, MACD, and RSI to identify optimal trade moments. Learn more in our guide on Mastering Moving Averages, MACD, and RSI on Binomo Platform.

Automated Alerts and Risk Management Features on Binomo

Binomo offers customizable alerts to notify you of price levels or time expiries, helping you stick to your Risk Management Checklist.

Integrating Third-Party Risk Analysis Tools

Consider complementing Binomo’s features with external tools for market analysis and risk assessment to enhance your trading strategy’s robustness. For more on trading risk, visit Investopedia Risk Management.

Common Mistakes to Avoid in Risk Management

Overleveraging and Overtrading

Avoid risking large portions of your capital in single trades or trading too frequently. These habits bypass your Risk Management Checklist and increase loss probability.

Ignoring the Risk Management Checklist

Disregarding your checklist leads to undisciplined trading and can quickly wipe out your account. Always follow your predefined rules.

Chasing Losses Instead of Sticking to the Plan

Trying to recover losses by increasing trade sizes or deviating from your strategy usually results in deeper drawdowns. Patience and discipline are key.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult a qualified financial professional before making investment decisions.

Frequently Asked Questions about Risk Management Checklist

How does Risk Management Checklist guide long-term planning?

Risk Management Checklist keeps investors aligned with measurable objectives, helping them compare new opportunities against existing allocation rules without emotional bias.

What risks should traders consider when applying Risk Management Checklist?

Market volatility, policy shocks, and liquidity constraints can magnify losses if Risk Management Checklist is used without scenario analysis or diversification buffers.

How can newer investors start using Risk Management Checklist effectively?

Documenting goals, benchmarking current holdings, and reviewing performance monthly empowers traders to apply Risk Management Checklist gradually while learning from data-driven feedback loops.

Which indicators reinforce confidence in Risk Management Checklist?

Economic growth trends, rate expectations, and sector-level earnings reports often validate whether Risk Management Checklist remains aligned with the broader investing climate.

Risk Management Checklist pros and cons

The strengths of Risk Management Checklist include a clear framework for assessing portfolio resilience, easier communication with stakeholders, and more consistent allocation updates.

The drawbacks of relying on Risk Management Checklist surface when data inputs become outdated or when investors ignore qualitative signals, which can delay necessary adjustments.