Introduction to Technical Analysis Indicators

Technical Analysis Indicators is one of the most practical approaches for traders on Binomo.  Learn more on Binomo.

Learn more on Binomo.

Technical Analysis Indicators are essential tools for traders looking to improve their binary options trading results. Understanding what these indicators represent and how to use them effectively can significantly enhance your trading decisions on the Binomo trading platform.

What Are Technical Analysis Indicators?

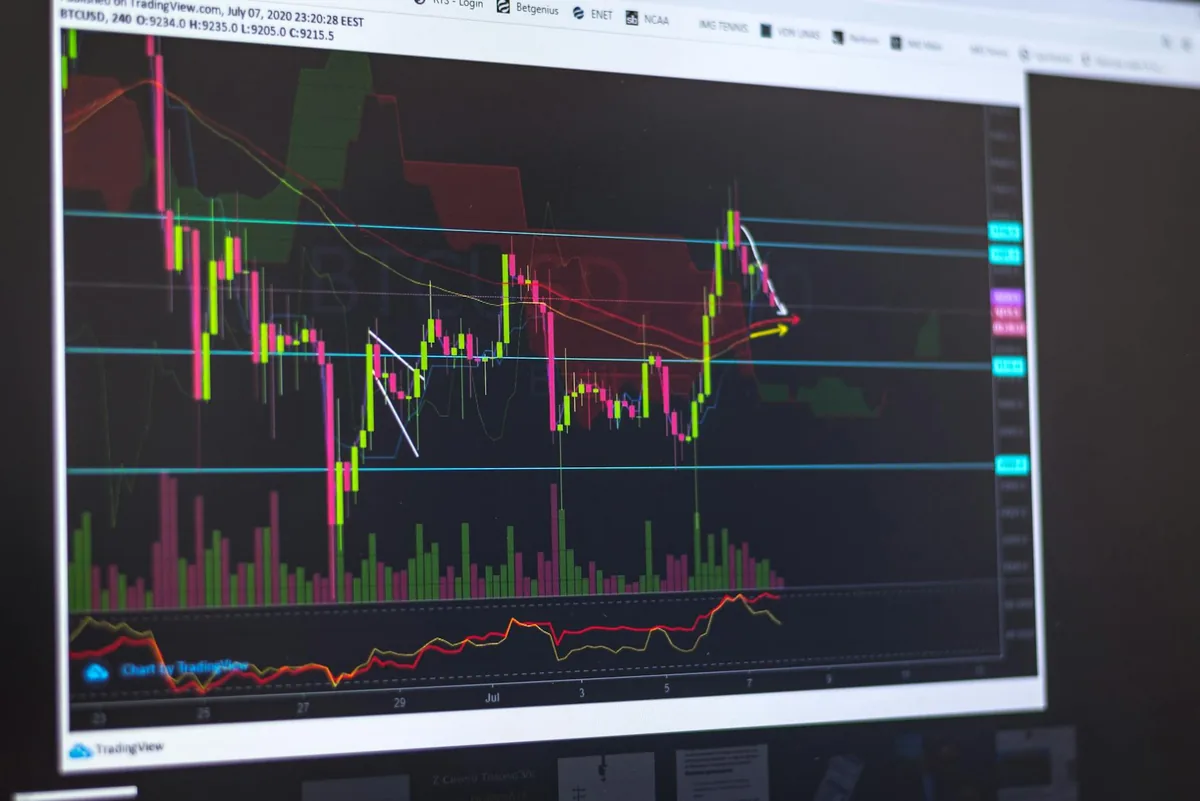

Technical Analysis Indicators are mathematical calculations based on historical price, volume, or open interest data. They help traders analyze market trends, identify potential entry and exit points, and forecast future price movements. These indicators are indispensable for interpreting market behavior beyond simple price action.

Why Use Technical Analysis Indicators in Binary Options Trading?

Using Technical Analysis Indicators in binary options trading provides objective data that can reduce emotional decision-making. They assist in spotting trends early, detecting reversals, and confirming signals, which is crucial given the high-risk nature of binary options. Indicators help traders develop systematic strategies rather than relying on guesswork.

Common Types of Technical Analysis Indicators

Among the wide variety of indicators available, some of the most common types include trend indicators like Moving Averages, momentum indicators such as the Relative Strength Index (RSI), and volatility indicators like Bollinger Bands. Each serves a unique purpose and can be combined for better accuracy.

Key Technical Analysis Indicators for Beginners

Moving Averages (MA) – Technical Analysis Indicators

Moving Averages smooth out price data to identify the direction of a trend. Simple Moving Average (SMA) and Exponential Moving Average (EMA) are popular variants. On Binomo, applying an MA can help you confirm if the market is trending up or down, aiding in timing your binary options trades.

Relative Strength Index (RSI) – Technical Analysis Indicators

The RSI measures the speed and change of price movements to identify overbought or oversold conditions. Values above 70 typically indicate overbought markets, while values below 30 suggest oversold conditions. This indicator is vital for spotting potential reversals.

Bollinger Bands – Technical Analysis Indicators

Bollinger Bands consist of a moving average and two standard deviation lines above and below it. They measure market volatility and provide clues about price breakouts or reversals. For a detailed explanation, check our guide on Mastering Bollinger Bands Strategy.

How to Interpret Technical Analysis Indicator Signals

Identifying Trends and Reversals with Technical Analysis Indicators

Recognizing when a market is trending or about to reverse is fundamental. Technical Analysis Indicators like Moving Averages show trend direction, while RSI and Bollinger Bands can hint at potential reversals when overbought or oversold levels are reached.

Overbought and Oversold Conditions with Technical Analysis Indicators

Indicators such as RSI help detect overbought and oversold conditions, signaling traders that a price correction may occur. It’s crucial not to rely solely on these signals but to use them in conjunction with other indicators.

Combining Multiple Technical Analysis Indicators for Accuracy

Using a combination of Technical Analysis Indicators improves the reliability of your trades. For example, confirming an RSI overbought signal with a Moving Average crossover can strengthen your confidence in a trade setup.

Setting Up Technical Analysis Indicators on the Binomo Trading Platform

Accessing Indicator Tools

Binomo’s user-friendly interface allows easy access to a range of Technical Analysis Indicators. Simply open the chart of your selected asset, click on the indicators menu, and choose the desired tools to add to your chart.

Customizing Indicator Parameters

Adjust indicator settings like periods or thresholds to suit your trading style and the asset’s behavior. Customization helps tailor signals to your preferred timeframe and market conditions.

Saving Your Indicator Templates

Once you have optimized your indicator settings, save them as templates on Binomo to quickly apply your preferred setups to other assets or charts, streamlining your trading workflow.

How to trade this on Binomo trading platform

Step-by-Step Guide to Using Technical Analysis Indicators for Binary Options

Begin by selecting an asset on Binomo and opening its price chart. Add your chosen Technical Analysis Indicators, such as Moving Averages and RSI. Analyze the signals they provide to identify potential entry points. For example, if the RSI indicates oversold conditions and the price touches the lower Bollinger Band, it may signal a buying opportunity. Place your binary options trade accordingly, setting appropriate expiry times that match your analysis.

Risk Management Tips for High-Risk Trading

Never risk more than you can afford to lose. Use proper money management strategies, such as limiting each trade to a small percentage of your total capital. Combine indicator signals with disciplined stop-loss approaches and avoid chasing losses.

🚀 Ready to test this strategy? Sign up for a free Demo Account on Binomo today.

Practice using Technical Analysis Indicators risk-free with a Binomo demo account. This allows you to refine your strategy before trading real funds.

Common Mistakes to Avoid When Using Technical Analysis Indicators

Relying on a Single Technical Analysis Indicator

Using only one indicator can lead to false signals. Combining multiple indicators provides a more comprehensive market view and reduces risk.

Ignoring Market News and Events

Technical Analysis Indicators don’t account for fundamental factors like economic news or geopolitical events, which can cause sudden price movements. Stay informed to avoid surprises.

Overtrading Based on False Signals

Indicators can produce misleading signals, especially in volatile markets. Avoid overtrading by waiting for confirmation and sticking to your strategy.

Advanced Tips for Improving Your Technical Analysis Indicator-Based Strategy

Backtesting Your Strategy

Test your indicator combinations on historical data to evaluate effectiveness before applying them live. Binomo’s demo platform is ideal for this purpose.

Adjusting Technical Analysis Indicators for Different Market Conditions

Markets can be trending or ranging. Modify indicator parameters accordingly—for instance, use shorter Moving Average periods in volatile markets and longer ones in stable trends.

Incorporating Volume and Timeframes

Volume indicators and multiple timeframes analysis add depth to your strategy, helping confirm signals and refine entry points. For more on binary options strategies, visit our comprehensive Binary Options Trading Strategies guide.

Conclusion and Next Steps

Summary of Key Points

Technical Analysis Indicators are powerful tools for enhancing your binary options trading on the Binomo trading platform. By understanding their functions, combining signals, and applying proper risk management, you can develop a disciplined trading approach.

Continuous Learning and Practice

Market conditions evolve, so continual learning and practice are essential. Use Binomo’s demo account to test new strategies without financial risk.

Exploring More Tools on Binomo

Binomo offers a range of indicators and features to support your trading journey. For guidance on managing your funds, see our How to Withdraw Funds from Binomo tutorial. For further reading on market concepts, check out this Investopedia article on Technical Indicators.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult a qualified financial professional before making investment decisions.

For authoritative definitions, review: official source.